A number of measures have been taken to promote the development of commercial insurance in the social field and better meet the needs of the people.

CCTV News:The State Council Information Office held a policy briefing yesterday (2nd) afternoon. The relevant person in charge of China Banking and Insurance Regulatory Commission said that China Banking and Insurance Regulatory Commission and other departments will jointly issue the Opinions on Promoting the Development of Commercial Insurance in Social Services, and put forward a number of policies and measures to promote the development of commercial insurance in social fields from five aspects.

According to reports, the Opinions will promote the development of commercial insurance in the social field from five aspects, including improving health insurance products and services, actively developing diversified commercial pension insurance, vigorously developing commercial insurance in education, housekeeping, culture and other fields, and supporting insurance funds to invest in social services such as healthy pension.

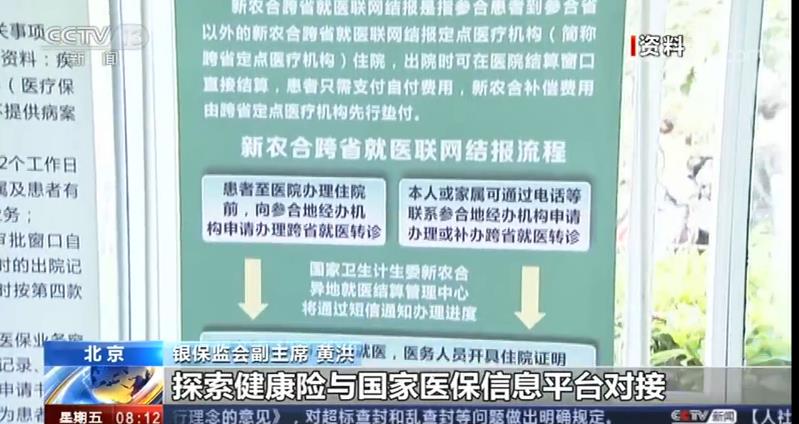

Huang Hong, vice chairman of China Banking and Insurance Regulatory Commission,Strive to achieve a health insurance market scale of over 2 trillion yuan by 2025. Support commercial insurance institutions to participate in medical insurance services and medical insurance control fees, and improve the supervision mechanism for the operation of major illness insurance. Explore the connection between health insurance and national health insurance information platform.

According to reports, in terms of commercial endowment insurance, we will strive to accumulate 6 trillion yuan of endowment insurance liability reserve for the insured by 2025. Explore and meet the insurance needs of the elderly aged 60 and over, and develop exclusive insurance products for the elderly with appropriate prices, flexible responsibilities and efficient services.

The opening up of the insurance industry has achieved remarkable results.

At the policy briefing of the State Council Office, the relevant person in charge of the personal insurance supervision department of China Banking and Insurance Regulatory Commission said that the insurance industry has achieved remarkable results in opening to the outside world and will continue to create an international, legal and market-oriented business environment for the development of foreign insurance companies in China.

The person in charge said that since April 2018, China Banking and Insurance Regulatory Commission has issued 14 measures concerning the opening-up of the insurance industry, including relaxing and canceling the restrictions on foreign shareholding ratio.

Liu Hongjian, deputy director of the personal insurance supervision department of China Banking and Insurance Regulatory Commission,From January 1, 2020, the proportion of foreign investment in joint venture life insurance companies can reach 100%.

According to reports, in 2019, two foreign-funded insurance institutions were under construction, and five foreign-funded insurance institutions opened.

Liu Hongjian, deputy director of the personal insurance supervision department of China Banking and Insurance Regulatory Commission, said,Foreign-funded insurance companies should be able to introduce some advanced concepts and management technologies in product development, capital utilization and risk management, and at the same time make positive contributions to improving the market system, enriching consumers’ choices and promoting the healthy development of China’s insurance market.

In the next step, China Banking and Insurance Regulatory Commission will continue to fulfill its commitment to opening up and create an international, legal and market-oriented market business environment for the development of foreign-funded insurance companies in China. At the same time, it will continue to strengthen the construction of the supervision system to ensure that the introduced institutions have excellent professional capabilities and sufficient capital strength.

Promoting the development of commercial insurance in the field of social services will promote the supply of "one old and one young" insurance products.

At the briefing, the relevant person in charge of China Banking and Insurance Regulatory Commission also said that the corresponding regulatory regulations will be formulated, and the regulatory baton will be used to promote insurance companies to pay more attention to the development of the old-age insurance market and the infant insurance market, so as to increase the supply of quality products.

According to reports, the exclusive insurance products for the elderly are very limited. Although there are thousands of insurance products currently on sale for the elderly aged 60 and over, the exclusive products are very limited and the premiums are relatively expensive.In particular, health insurance, insurance products with the same amount of protection, the premium of the elderly may reach ten times that of young and middle-aged people.

In addition, Huang Hong, vice chairman of China Banking and Insurance Regulatory Commission, said that apart from the elderly, there are few exclusive products for children under 6 years old.In the next step, the Banking Insurance Regulatory Commission should increase the product supply of old-age population insurance and infant insurance in terms of "one old and one young", make efforts from both quantity and quality, formulate corresponding regulatory regulations, and use the baton of supervision to promote insurance companies to pay more attention to the development of old-age insurance market and infant insurance market.