How are the college students who rely on flowers and white stripes?

CCTV News:Wang Gang, who just finished his college career, did not choose to take a graduation trip with his classmates. He was busy submitting his resume and looking for a job. Wang Gang is in urgent need of a job. He will use his salary to repay the JD.COM white stripes and ant flowers he owed when he was an undergraduate.

Wang Gang graduated from a first-class university in Beijing with a bachelor’s degree. There are six boys living in the dormitory. Four of them enjoy the JD.COM IOUs quota of 20,000 yuan, and three of them are in arrears with Ant Financial Service.

Wang Gang’s family is not bad, and his father is an executive in a private enterprise. However, the parents refused to repay the debts of Ant Financial Service and JD.COM IOUs for Wang Gang. They couldn’t understand why their son needed to borrow money from the e-commerce platform when he provided more than 4,000 living expenses every month.

"In fact, it’s not worthwhile to think about it. There is really no need to buy a lot of things. I bought a lot of things that were useless several times, or even useless at all. At that time, I calmed down when I bought them, so I wouldn’t owe so much. "

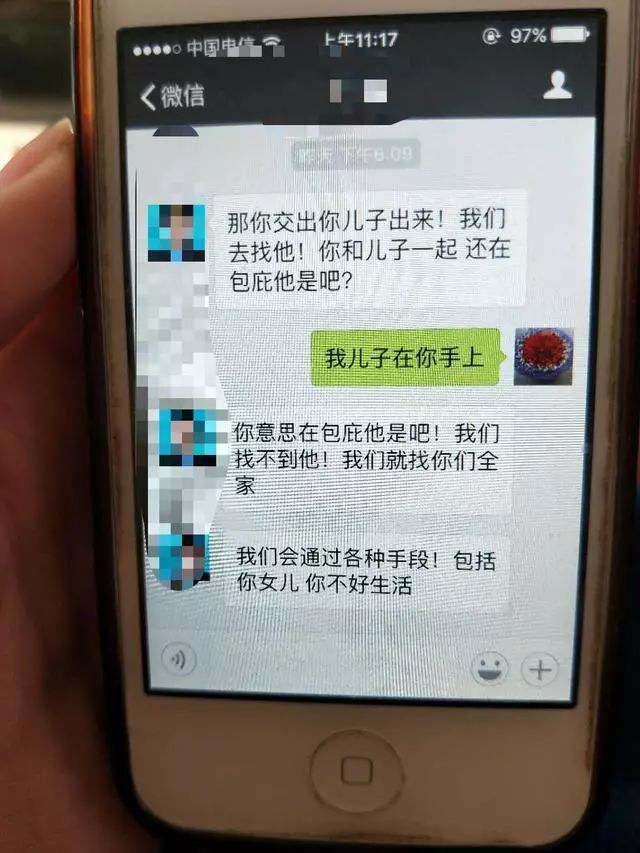

Wang Gang’s dilemma is not a case. Among contemporary college students, consumption ahead of time and borrowing consumption have long been a common phenomenon. Several tragedies caused by campus loans a few years ago have raised the vigilance of young students on "campus loans". Coupled with the crackdown by law enforcement agencies and the condemnation of public opinion, the illegal lending platform that once grew wildly seems to be silent, but it has not been eliminated.

In March this year, a college student in Zhangjiakou City was found dead in a local hotel. The boy’s father said: "It is suspected that his son’s death is due to" campus loan reminder ".Since January, he has received several loan reminder calls."

In January of this year, a 19-year-old girl in Changsha was caught in the quagmire of cash loans and borrowed from at least 18 companies in half a year. Her mother committed suicide by taking pesticides because of too much pressure.

In September this year, Xiaowen, a student who just attended the first year of a college in Beijing, looked at all kinds of campus loan advertisements posted on the bulletin boards and toilets in the school, and he had a lingering fear. Just half a year ago, after she decided to go to graduate school, she began to borrow money from the campus. In half a year, the loan "rolled" from the original 4,000 yuan to 200,000 yuan. At one time, she didn’t have the courage to come to the new school. Finally, her parents sold the house to pay off her debts.

In May 2017, the Notice on Further Strengthening the Standardized Management of Campus Loans jointly issued by the China Banking Regulatory Commission, the Ministry of Education and other ministries and commissions suspended all online lending institutions from providing online lending services to college students, and made it clear that institutions established without the approval of the China Banking Regulatory Commission were not allowed to enter the campus to provide credit services. A large number of lending platforms have introduced relevant restrictions, such as raising the age limit of borrowers to 23, and those without fixed income cannot borrow.

However, for college students who have strong consumer demand but lack a fixed source of income, they have found a safer and more legal consumption channel, flowers and white bars.

Live what I want.

Wang Gang was worried about the "Double Eleven" in his freshman year. That year, in order to save money to buy a favorite winter coat, he had to cancel his winter vacation trip to Taiwan Province. After that, when JD.COM White Stripes started to be activated, Wang Gang felt completely liberated. The quota of 2,000 yuan was converted into a pair of imported brand-name sneakers, which earned dozens of praises for Wang Gang’s circle of friends. The good times didn’t last long. In order to pay off his debts, he almost collapsed after nearly two weeks of austerity. What makes Wang Gang feel uncomfortable is the mental pressure brought by the white bars. In the end, he raised his phone and asked his mother for help. After some criticism, he still got 3 thousand relief and paid off his debts.

In April 2017, Ant Flower Garden released an advertisement "Young is Flower Garden". In the advertisement, three energetic young people easily realized their dream life state with the help of Hua Bai, and the advertisement word "live what I want" is even more exciting. A similar advertising copy also appeared in JD.COM’s white-striped advertisement "To Young People Who Hold Their Urine". Four young people with simple clothes and poor lives ate cheap instant noodles in Starbucks, but because of the white stripes, they quickly improved their quality of life.

Even though I haven’t seen these advertisements, many young people like Wang Gang also choose to open white stripes and white flowers, because the actual consumer demand and their unmatched economic ability, coupled with the generous repayment conditions of JD.COM and Ant Financial, really touched their pain points.

As the representative of advanced consumption nowadays, JD.COM White Stripes and Ant Flower Blossoms have become the most frequently used loan platforms for contemporary college students. JD.COM IOUs, which "shop first and pay later", offer a 30-day interest-free period and 24 installments, with a maximum credit line of 200,000 yuan. Compared with the white stripes in JD.COM, the consumption range of ant flower buds is broader. Ant Flower Garden is independent of any e-commerce platform, and it has almost zero threshold. As long as you register Alipay with your real name, you can open it. As long as the repayment is made within the prescribed time limit, no interest will be charged.

But in fact, most young people who open and use flowers and white stripes spend their money on luxury consumption. The data shows that women’s fashion products such as women’s wear, accessories and beauty cosmetics account for more than 20% of the goods purchased by ant flower beds.

The price behind the interests

Young, online consumption, and daring to try, the common characteristics of these post-90 s consumers have also stimulated the e-commerce platform to continuously launch dazzling preferential activities. Around the flower garden payment, online activities launched by Alipay include all kinds of red envelopes, sweepstakes and gift certificates, which attract not only young people.

In June last year, Xiao Liu’s mother opened Alipay. In order to earn red envelopes and bounty, she encouraged the whole family to open Alipay function. Almost every day, they send red envelope passwords to each other. "At first, a family could get five or six yuan a day, and my mother joked ‘ Ma Yun’s father sends our family a dish every day ’ 。”

With the change of the nature of red envelopes, Xiao Liu and her mother have successively opened flower buds and Yu ‘ebao. "In April this year, mom and dad suddenly made a video with me and asked me to teach them how to close the flower garden because they were late ‘ One-click flowers ’ The flower garden was set as the first payment, which was not found for more than two months and was charged interest. "

The essence of "loan arrears" has not changed.

No matter how easy it seems, every penny lent must be repaid. If illegal campus loans are "sharp knives and daggers", then advanced consumption is like a chronic poison, only with less pressure and slower corrosion to borrowers. After the crazy consumption, you will see such helpless ridicule as "eat the soil next month", "Don’t look for me if the bureau exceeds 50 cents" and "accompany instant noodles".

"Spend tomorrow’s money and enjoy today’s happiness" is the idea that the advertisements with white stripes and flowers are expected to convey, but behind these advertisements, they all cleverly avoid a real problem — — Who will pay tomorrow’s debts?

The money owed will be paid back sooner or later.

As an advanced consumption mode, the amount of Ant Flower Blossom is not a free gift, and behind those concessions and bonuses, it is still a means to stimulate consumption. For college students with no fixed income, the repayment channels of Ant Financial Service and JD.COM White Bar are nothing more than the following: begging parents, going out to work part-time, saving money, and even "borrowing money to pay debts" to rob Peter to pay Paul.

Xiao Chen, who is just a senior, has a plan for consumption. In addition to double eleven and double twelve concentrated consumption, flower buds are rarely used. His arrears will be repaid within the prescribed time limit, mainly by deducting them from the living expenses given by his parents next month.

"The flowers are cool for a while, and the money is returned to the crematorium." Jiang Song, a third-year master of the School of Psychology of Renmin University, said, "I opened the ant flower garden just to snap up a sneaker on the Double Eleven. Since then, I have rarely used it. Generally, I have received a flower garden red envelope for consumption, but recently the flower garden red envelope is only a dime or even a few cents, so I don’t need it."

But not every college student has strong self-control. At the express delivery points of major universities, students can always see the scene of queuing for express delivery, and a few days after the Double Eleven, there will be dense long queues.

An Apple notebook, a Nikon SLR lens, and various daily necessities, this is the result of last year’s Double Eleven Xiao Pan’s IOUs on the JD.COM platform. This also means that in the past ten months, Xiao Pan has to repay debts of more than 800 yuan every month. As a master of a double-class university, Xiao Pan can receive the postgraduate subsidy from 600 yuan and the internship service fee from 800 yuan every month. Together with the salary of being on duty in the school employment office, Xiao Pan can earn about 2,800 yuan a month, and there seems to be no pressure to repay the IOUs. "But what I am most afraid of is dinner, especially in June and September, the farewell dinner in the graduation season and the hometown meeting in the school season, so I have to borrow money from my classmates around me."

"In fact, I don’t want to spend so much. My JD.COM white stripes and ant flower buds have a total quota of only 4,000 yuan, but in the Double Eleven, the flower buds suddenly raised the quota to 6,500 yuan. Therefore, after weighing the left and right, the quota of 6,500 yuan became a Nikon lens. "

For most students who are in debt and have no financial resources, "robbing Peter to pay Paul" is the only way, and "going ashore" has become a distant legend. When they find that their bills have accumulated to four or even five figures, college students who borrow money will have a serious sense of crisis. In the process of overdraft consumption again and again, they will only get farther and farther away from their ideal life.

"The campus loan platform can easily get loans without proof of income, and students are not sensitive to interest. Once students fail to pay interest or late fees, they will bear the pressure of "snowballing" to pay their debts, which is tantamount to pushing them to the brink of collapse for a student without economic income. Violent collection can easily lead to students’ psychological crisis and eventually lead to tragedy. " The relevant person in charge of China Everbright Bank Beijing Branch said at the "First Class of Financial Security" held by Beijing Film Academy.

More than half of October, can "Double Eleven" be far behind? (Intern reporter: Liu Zexi reporter: Liu Wei)